Political Parties, elections and agriculture

Like 65 other countries South Africa will have general elections this year. 52 political parties are competing for the national vote. How is an electorate

Written by Wandile Sihlobo

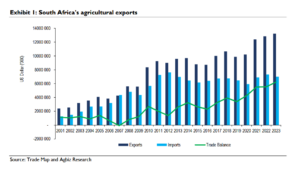

The products that dominated the export list were citrus, maize, apples and pears, nuts, wine, soybeans, sugar, wool, grapes, berries, avocados and fruit juices. This improved export activity was a function of improvement in volumes and prices. That said, pricing developments over the year were significantly more varied than the average data suggest. While fruit prices picked up, grains and oilseed prices have declined notably from the 2022 levels.

Notably, the exports were widely spread across various key markets. The African continent remained a leading market, accounting for 38% of South Africa’s agricultural exports in 2023 in value terms. Asia was the second largest agricultural market, accounting for 28% of exports, followed by the EU, the third largest market, accounting for 19%. The Americas region was the fourth largest, accounting for 6%, and the remaining 9% went to the rest of the world. The UK was one of the leading markets within the ‘rest of the world’ category, accounting for 7% of total exports. The products of exports to these markets were primarily the same, with the African continent and Asia importing a reasonably large volume of maize, soybeans, wool and beef. Meanwhile, exports to other regions were primarily

fruits and wine.

These robust export earnings were achieved in the face of various challenges in our ports, electricity supply and critical export markets. Some credit goes to organized agriculture groupings, the government, Transnet and different logistical groups that have worked to ensure a smooth flow of products to export markets. The South African agricultural industry has established forums to continuously engage with Transnet and enhance communication about problems at the ports so that the response could be swift to drive the exports of high-value and perishable products. Still, more work is needed as this export success has come at a significant cost to producers and various

stakeholders in the value chain.

South Africa’s trade is not one way – the country is also a notable importer of various agricultural products. In 2023, South Africa’s agricultural imports amounted to US$7,0 billion, down 4% from the previous year, primarily because of the decline in commodity prices, while the volume of imported products remained roughly unchanged from the past year. The top imported products were rice, palm oil, wheat, poultry, and whiskies. These products originated primarily from Asia, the EU, the UK, and the Americas. Considering this import value against the export value of US$13,2 billion, South Africa’s agriculture realized a record trade surplus of US$6,2 billion.

While the recent export expansion is encouraging, South Africa should stay focused on improving the logistical infrastructure efficiency and on the export market expansion mission for the agricultural sector. Remarkably, agricultural exports improved in a year where we saw severe load-shedding and significant logistical infrastructure constraints at the ports.

The exports could have been much higher than the current levels without these constraints. There is a need for increased investment in port and rail infrastructure, along with the improvement of roads in the farming towns that continue to constrain the sector’s growth. Importantly, expanding South Africa’s export markets will require better-performing logistical infrastructure.

The ambition of broadening the export markets is significant as various countries increasingly turn inward and raise multiple kinds of protectionism. We see such protectionism tendencies in the EU and the region in countries like Botswana and Namibia.

This means there is a need to work hard to retain the existing markets in the EU, African continent, Asia, Middle East, and the Americas. Importantly, in an increasingly divided and fragile world, South Africa must walk a careful path so that its foreign policy approach does not result in a negative trade policy response from its traditional trading partners. This is fundamental for South Africa’s agricultural growth, sustainability, and job creation.

Moreover, South Africa should expand market access to some of the key BRICS+ countries, such as China, India, and Saudia Arabia. Other strategic export markets for South Africa’s agricultural sector include South Korea, Japan, Vietnam, Taiwan, Mexico, the Philippines and Bangladesh. This export market expansion ambition is shared by both the private sector and the South African government.

The Department of Trade, Industry and Competition and the Department of Agriculture, Land Reform and Rural Development should lead the way for export expansion in these agricultural strategic markets. The outcome of the 15th BRICS conference in agriculture also focused on deepening trade within the BRICS+ countries while retaining other markets outside this grouping. This was anchored on the emphasis for BRICS members to lower import tariffs and address SPS barriers hindering deeper trade within this grouping.

This article originally appeared in the 4 March 2024 Agbiz newsletter. Find the article here.

Relevant Agribook pages include “Exporting“.

Photo by Ian Taylor on Unsplash

Like 65 other countries South Africa will have general elections this year. 52 political parties are competing for the national vote. How is an electorate

Press release A pioneering solution has been developed to convert cellulose fibre-rich waste from pulp and paper mill operations into ethanol using a specialised fermentation

Why rangelands matter, and why misguided initiatives here do more harm than good …